OACOX

OACOX

OneAscent Capital Opportunities Fund

OACOX is an Interval Fund with an investment objective to achieve a blended return of income and capital appreciation through a diversified portfolio of private market assets including private equity, venture capital, real estate, real assets, private credit and liquid alternatives. OneAscent Capital seeks to identify investments in these sectors that are values aligned with OneAscent and have the potential for positive impact on the world. OACOX is designed to be available to investors of all types and allows even non-accredited investors access to a diversified private markets portfolio in a single investment vehicle. The Fund is a continuously offered, diversified, closed-end management investment company.

Accessible

OACOX is open to all investors giving them the opportunity to invest in innovative, private companies that have had high growth, emerging fund managers and constrained funds with a $5,000 initial investment

Aligned

OACOX gives investors confidence they can have exposure to private markets that is aligned with their values and their desire to have a positive impact on issues that are important to them

All-in-One

OACOX is an interval fund that gives investors a single investment to get a professionally managed portfolio of private market investments, with easy purchasing and reporting

| Fund Details | As of 10/26/2025 |

|---|---|

| Ticker | OACOX |

| CUSIP | 68269Q105 |

| Inception Date | 12/27/2024 |

| Gross Expense Ratio | 3.79% |

| Distribution Frequency | Quarterly |

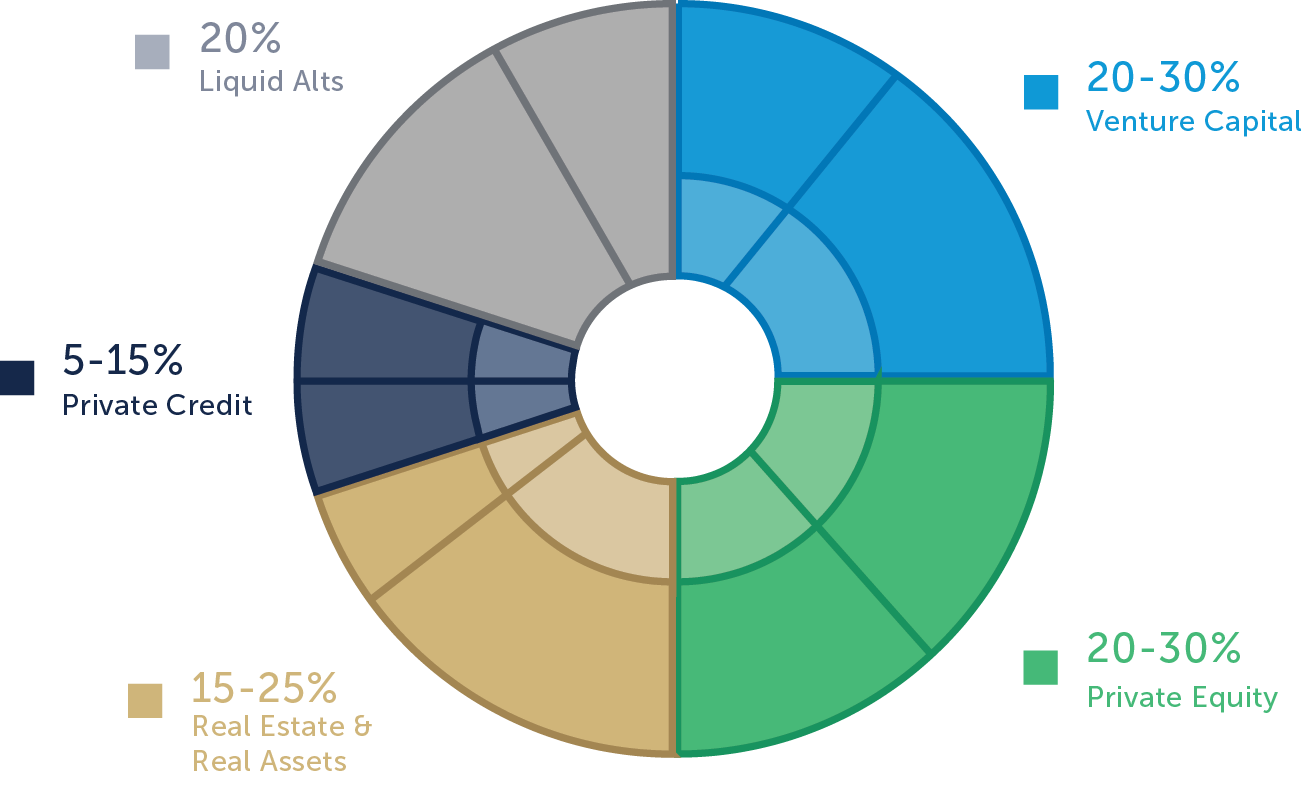

Target Portfolio Construction

The Fund targets allocations of up to 65% in Direct Investments, up to 20% in Liquid Alts, and up to 15% in Private Funds.

Investors should carefully consider the investment objectives, risks, and charges and expenses of the fund before investing. The prospectus contains this and other information about the fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 1-800-222-8274. The fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC, which is not affiliated with OneAscent Investment Solutions, LLC.

Important Risk Information:

- Investing involves risk, including loss of principal. The value of the fund's shares, when redeemed, may be worth more or less than their original cost.

- The Adviser invests in securities only if they meet both the Fund’s investment and values- based screening requirements, and as such, the returns may be lower than if the Adviser made decisions based solely on investment considerations.

- The Fund invests in private funds, which are subject to their own strategy-specific risks such as default risk, leverage risk, derivatives risk and market risk. Fund shareholders will also bear two layers of fees and expenses in connection with investments in private funds. In addition, private funds are subject to illiquidity risk.

- The Fund’s shares are not listed on any securities exchange and are not publicly traded. There is currently no secondary market for the shares. Liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the shares outstanding at NAV and no more than 25% of its outstanding shares. The Fund will not be required to repurchase shares at a shareholder’s units, interests or shares of any security and there is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer.

- The Fund is not required to extend, and shareholders should not expect the Fund’s Board of Trustees to authorize, repurchase offers in excess of 5% of outstanding shares.

The Fund or an Underlying Fund may invest in venture capital. Venture capital is usually classified by investments in private companies that have a limited operating history, are attempting to develop or commercialize unproven technologies or implement novel business plans or are not otherwise developed sufficiently to be self-sustaining financially or to become public. Although these investments may offer the opportunity for significant gains, such investments involve a high degree of business and financial risk that can result in substantial losses, which risks generally are greater than the risks of investing in public companies that may be at a later stage of development.

The Fund is newly formed and has no operating history.

The Fund is a closed-end investment company. It is designed for long-term investors and not as a trading vehicle.

Competition for Investment Opportunities Risk - The activity of identifying, completing and realizing the types of investment opportunities targeted by the Adviser and Sub-Advisers for the Fund is highly competitive and involves a significant degree of uncertainty.