Why Private Markets?

Business impacts the world in powerful ways. Therefore, we invest intentionally.

The Value of Investing in Private Markets

There are good reasons to include private equity investing in a portfolio, and why institutional investors allocate significantly to this asset class. OneAscent is making it available to every investor. Here are 4 reasons to invest in private markets:

Enhanced Return Potential

Access to High Growth Innovative Companies

Increased Diversification Benefits

Direct Opportunity for Positive Impact

TRENDS that Shift Value Creation towards Private Markets:

Investing in private markets should be a long-term strategy focused on developing an investment program rather than just investment opportunities.

There are good reasons to consider starting that program now. There are trends in the relationship between public and private markets that makes private markets more attractive both now and over the long term, and changing the risk premium between them.

Why is this important? Generally, investors have favored public markets due to easier access to investments, greater liquidity, and less risk compared to investing in private markets.

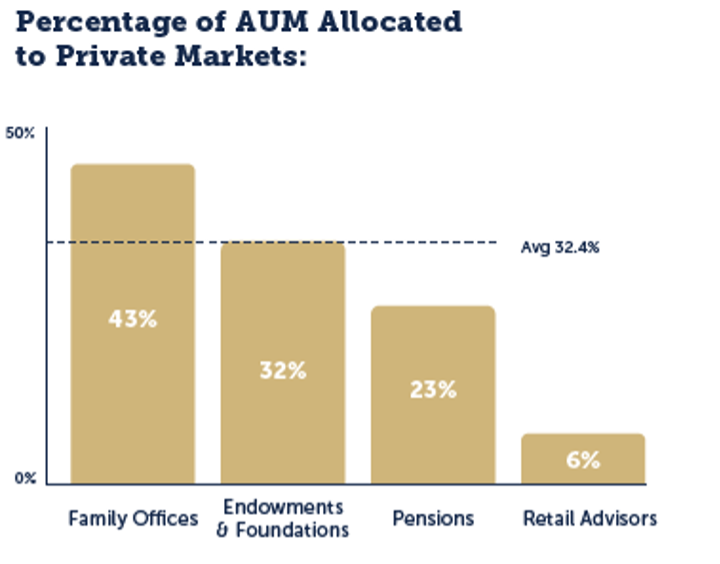

Conversely, institutional investors such as family offices, endowments, foundations, and pensions have a much higher allocation of their assets to private markets. In fact, they allocate 5 times more to private markets than clients of retail advisors.[1]

Here are a few reasons why they allocate more to alternative assets than other investors.

Public Market Concentration – The concentration of the total public market capitalization as exhibited in the S&P 500 Index or Nasdaq Index has reached historic highs. As this trend continues, there is a concentration of risk that may be underappreciated with passive index-based investments. Volatility in a single company could lead to large fluctuations and decreases in the overall index if that volatility is negative. As that risk increases, it favors private markets where risk exists but can be managed through active portfolio diversification.

In addition to greater access, more flexible investment vehicles, and the changes in relative risk between public and private markets, other dynamic trends further change the balance between public and private markets. These are a shift in company value creation towards private markets relative to public markets and the much larger universe of private companies versus public companies.

Value Creation – the creation and capture of more of the value in companies is shifting to private markets. Companies are staying private longer, and they often go public when they are much larger in value. That value growth is captured by investors in the private market, at the expense of those only investing in public markets.

Larger Investable Universe – there are 50 times more private companies to invest in than publicly traded companies[2], making it practically impossible to index private markets. This is one reason why manager selection is more important in private markets, because there is not a passive investment option like those that exist in public markets that track the S&P 500, Nasdaq, or other indices. The larger universe also creates inefficiencies in information, investment sourcing, and capital that can favor professionally managed portfolios

VC-Backed Companies as a Percentage of Public U.S. Companies Founded since 1979

Private capital is the foundation of building public companies. Those companies venture backed since 1979 now make up 50% of the public companies today and have a higher relative value to other public companies, making up 77% of total market capitalization. Growth and innovation continue to progress as these companies make up 92% of research and development of public companies today.

50%

Total Number

77%

Total Market Capitalization

92%

Research & Development

Download the OneAscent Capital and Private Market Investing Brief

[1]Source: Fidelity “A Study of Allocations to Alternative Investments by Institutions and Financial Advisors”, 2022; Blackrock “2022-23 Global Family Office Report"

[2]Source: National Center for The Middle Market, 2023; McKinsey, 2021, ~182,000 private companies with revenues greater than $10m vs ~4,000 public companies